Gain financial insights and maximize profitability

Optimize your financial operations with Dynamics 365 Finance

Trusted By Many Companies

What is Dynamics 365 Finance?

Dynamics 365 Finance is an Enterprise Resource Planning (ERP) solution designed to enable organisations monitor the performance of financial operations in real-time, predict outcomes, and make data-driven decisions to drive business agility and growth. It empowers users to do business anywhere, anytime, with an intuitive user-interface personalized for their role and preferences

Dynamics 365 Finance Key Features

General Ledger Management

Seamlessly create corporate chart of accounts comprising main and subsidiary ledgers. Manage currencies, journal entries, allocations while leveraging various GL-based reports for decision making.

Accounts Payable

Manage vendors, terms, contracts and contact details. Create purchase requisitions, purchase orders and confirmations; receive goods into inventory; and create returns of defective goods. Seamlessly manage trade agreements and rebates while managing workflow approvals.

General Ledger Management

Dynamics 365 Finance presents a very streamlined, organized and user-friendly solution that supports the configuration and customization of account receivables management, to meet the needs of vast and variety of business entities with multiple credit and payment arrangements.

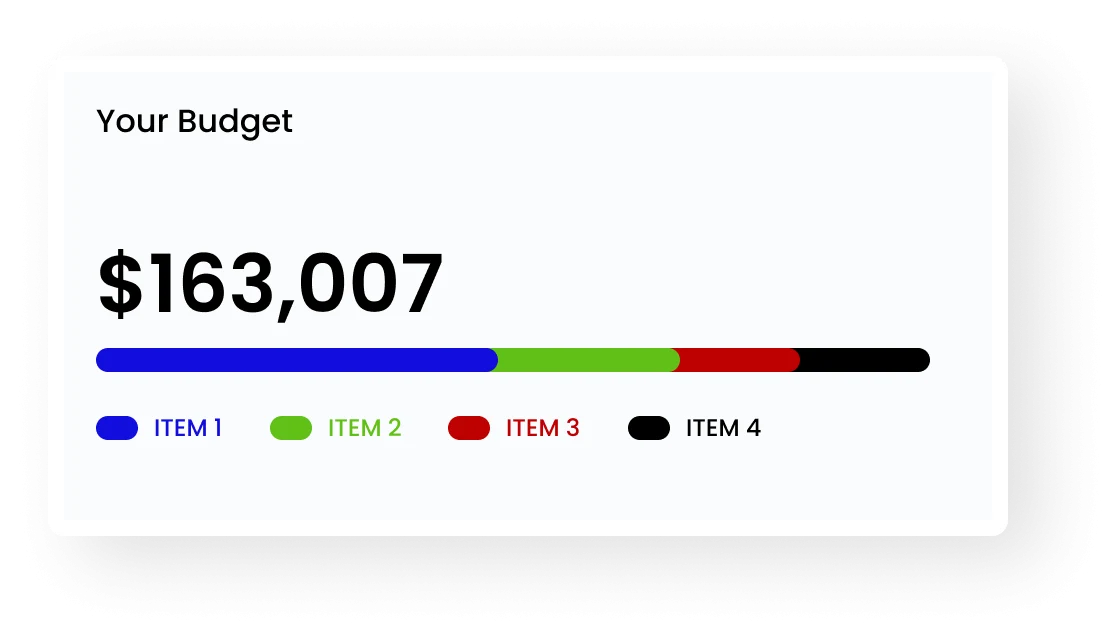

Budgeting

Improve your organisation’s flexibility to develop, modify, and control budgets so you don’t get overextended and stop overspending before it’s an issue.

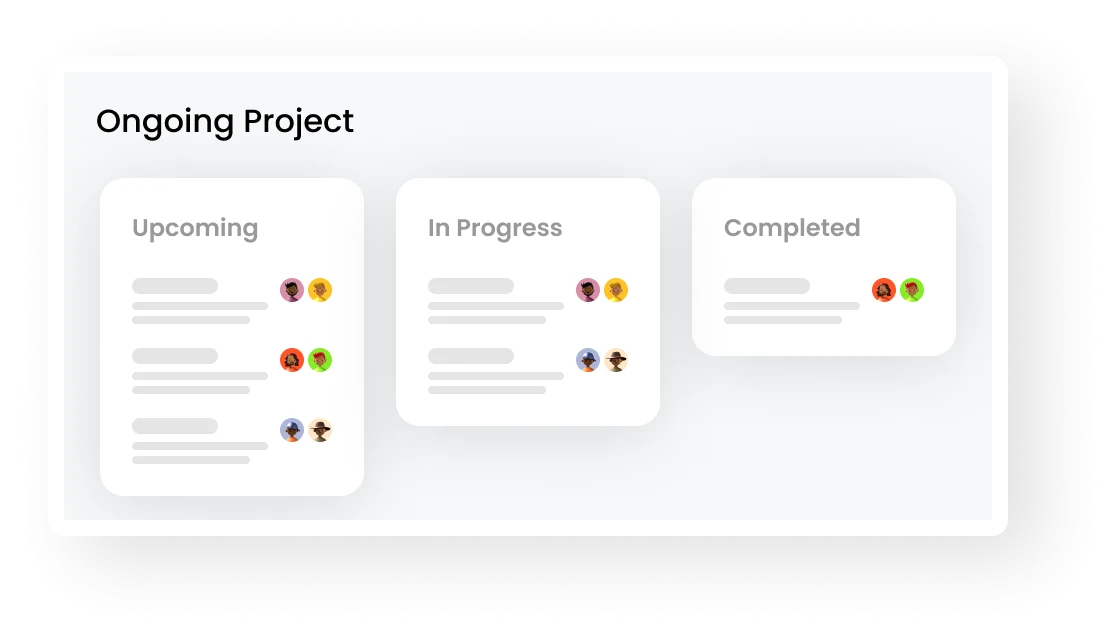

Project Management

Create, manage, and track customer projects with sophisticated job costing and reporting capabilities. Effectively schedule employees, inventory items, and tasks related to specific jobs.

Fixed Asset Management

Get to create and manage assets by type and category, manage depreciation and value models, assets’ end of life, as well as sale and transfer of assets.

Cash and Bank Management

Manage bank accounts, check registers and format check types.

Human Resource

Effectively assign employee roles, create performance plans and manage employee benefit plans and payroll.

Benefits of Dynamics 365 Finance

Enhance your financial decision-making

Get to leverage real-time, global reporting,embedded analytics and predictive insights to assess the health of your business, improve financial controls, optimse cash flow and drive growth.

Unify and automate your business process

Integrate core business processes with financials and automate standard tasks to boost user productivity, support evolving business models and maximise financial performance

Reduce global financial complexity and risk

Quicky adapt to changing financial requirements with a rules-based chart of accounts and a no-code configuration service that simplifies regulatory and tax reporting, electronic invoicing and payments.

Make strategic impact while reducing costs

Minimise costs and optimise spending across business geographies with process automation, budget control, and financial intelligence, planning, and analysis.