Bank of Uganda Transforms

Operations with Secure and

Scalable Data Replication Solution

Industry: Finance

Customer Name: Bank of Uganda

Industry: Finance / Banking

Country: Kampala, Uganda

Solution: Electronic Money Data Replication Service (EMDRS)

Partner: Reliance Infosystems

Overview

The Bank of Uganda (BoU) upholds the mission to maintain macroeconomic stability and a sound financial system in Uganda. As the central bank, it oversees and regulates the activities of Ugandan financial institutions. With its status as the first bank of the nation, BoU required certain implementations to expand its capabilities to serve the people of Uganda better.

The Pain Points

BoU observed that it became increasingly complex to integrate data from multiple Electronic Money Issuers (EMIs) due to the differences in data sources and formats. They also struggled with real-time data processing as the data replication and analytics capabilities to propel timely decision-making and regulations were unavailable. For a national bank, data processing and analytics are a priority as the results become key indicators for decisions that determine the financial position of a whole country.

Beyond these challenges, there was the final issue of security and compliance. As a regulatory body they also need to meet stringent security requirements to maintain data privacy and integrity of customer information. A data breach from a national bank is a catastrophe that must be avoided and BoU was proactive in implementing strategies to maintain top-notch security.

The Pivotal Moment

Solution Deployed

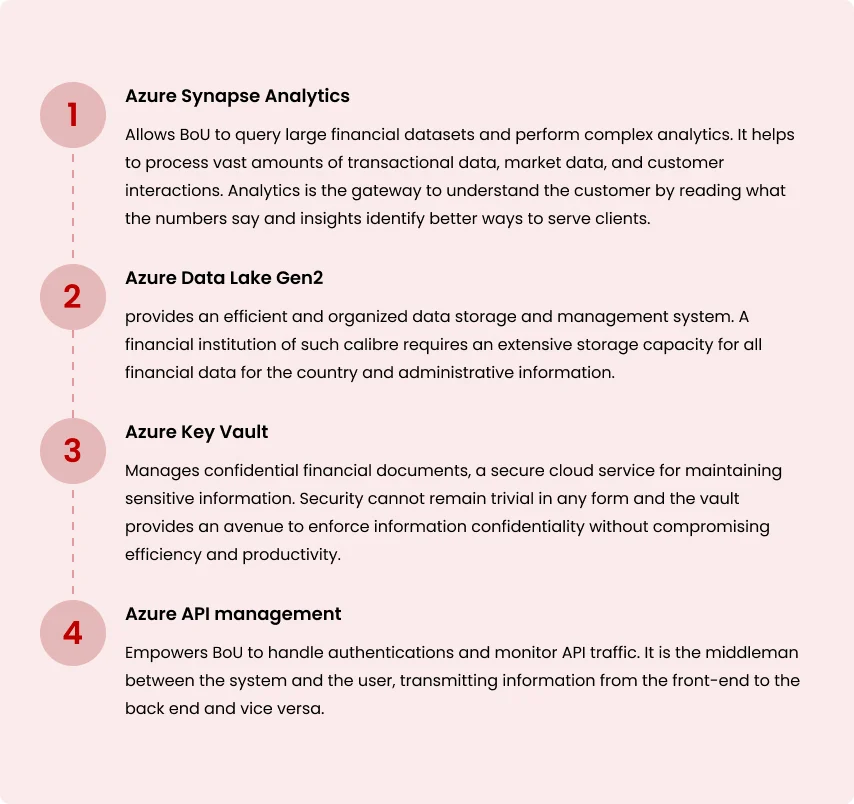

After careful consideration, the Reliance Infosystems team implemented the Electronic Money Data Replication Service (EMDRS) system. This solution consists of several Azure-based technologies including Azure Synapse Analytics, Azure Data Lake Gen2, Azure Key Vault, and Azure API Management. The solution enabled real-time data ingestion, secure data storage, and advanced analytics capabilities. In more details, each solution’s value is highlighted below:

Azure Synapse Analytics

Allows BoU to query large financial datasets and perform complex analytics. It helps to process vast amounts of transactional data, market data, and customer interactions. Analytics is the gateway to understand the customer by reading what the numbers say and insights identify better ways to serve clients.

Azure Data Lake Gen2

provides an efficient and organized data storage and management system. A financial institution of such calibre requires an extensive storage capacity for all financial data for the country and administrative information.

Azure Key Vault

Manages confidential financial documents, a secure cloud service for maintaining sensitive information. Security cannot remain trivial in any form and the vault provides an avenue to enforce information confidentiality without compromising efficiency and productivity.

Azure API management

Empowers BoU to handle authentications and monitor API traffic. It is the middleman between the system and the user, transmitting information from the front-end to the back end and vice versa.

The critical roles these solutions play affords BoU the capacity to process, analyze, and secure data effectively while complying with industry standards. Compared to the experience before the intervention of Reliance Infosystems, our deployed solutions enhanced processes such that the BoU representatives wished their challenges had been resolved sooner.

Engagement With Microsoft

Implementing BoU’s Electronic Money Data Replication Service unlocked a new realm as they experienced a 65% boost in efficiency. The team no longer required heavy manual interventions since data ingestion and processing workflows became streamlined. The automated data pipelines and real-time analytics boosted productivity and improved operational efficiency. Additionally, Azure’s scalable infrastructure accommodated growing data volumes seamlessly. The heightened security measures improved compliance levels. Together, BoU increased the pace of decision-making, leading to significant ROI.

Unpack The Complexities

“Reliance has offered the Bank of Uganda a platform to open our eyes, especially from a relationship perspective. We appreciate that and believe that going forward there is a lot in the ocean for both of us. Thank you for your kindness and support from so many dimensions and thank you for giving us the motivation on our projects and many others that will come.”– Peter, Project Manager.

Key Metrics

65%

Boost in Efficiency

82%

Customer satisfaction

60%

Boost

85%

Boost in service Delivery

Interested in optimizing your operations for efficient and scalable outcomes with our Azure-based technologies? Book a Free Discovery session {HERE} with our specialists to get started.

Similar Stories

Frebloom Marine M365